East Asia Business Telegraph Weekly – April 5

A weekly round-up of leading business/economic stories shaping East Asia from the pages of the regional press

CHINA/Finance – “Alibaba affiliate Ant Financial has launched an asset management service in collaboration with US-based asset management firm Vanguard Group to meet investment demands from retail consumers. The service was officially rolled out yesterday through Ant Financial’s smartphone financial service application Alipay, which has some 900 million users,” Shanghai Daily reports

CHINA/Equities – “Luckin Coffee Inc’s shares crashed more than 75 percent after the company revealed an internal investigation that alleged its COO was involved in 2.2 billion yuan ($310 million) in fabricated transactions over the past year. he company, a so-called rival to Starbucks Corp in China, said on April 2 the internal probe revealed the aggregate sales amount associated with the fabricated transactions from the second quarter of 2019 to the fourth quarter of 2019 amounted to around 2.2 billion yuan,” China Daily reports.

REGIONAL/ADB Report – “Regional economic growth in developing Asia will decline sharply in 2020 due to the effects of the novel coronavirus (COVID-19) pandemic, before recovering in 2021, according to the Asian Development Outlook 2020, the Asian Development Bank’s (ADB) annual flagship economic publication. Excluding Asia’s high-income newly industrialized economies, growth will drop from 5.7% to 2.4% this year before recovering to 6.7% next year, says ADB. Nine Asian economies that rely on tourism and commodities are likely to shrink, the ADB said, and the hardest hit would be Thailand,” Thailand Business News reports.

REGIONAL – “The World Bank is estimating that the coronavirus outbreak will cause economic growth to slow significantly this year in China and other East Asian-Pacific countries, throwing millions into poverty. Under a worse-case scenario, the region could suffer its sharpest downturn since a devastating currency crisis more than two decades ago, the bank said in an updated forecast,” Japan Today reports.

S. KOREA/Korean Air – “Korean Air Lines issued a desperate plea for government support Thursday, arguing shared interest and alluding to economic catastrophe if no direct funding is provided. ‘The airline industry is a basic industry that supports a country’s fundamental,’ the company said in a statement. ‘Considering that Korea relies highly on imports and exports, Korean industries could collapse if the airline industry falls,'” Korea JoongAng Daily reports.

HONG KONG/HSBC – “HSBC chief executive Noel Quinn sent a letter to each of the bank’s shareholders in Hong Kong on Friday to explain the lender’s decision to cancel its dividend this week and reassure investors of its strong capital position. The unusual step of writing directly to the bank’s shareholder base in the city came after a torrid three-day stretch that saw about US$15 billion shaved off the company’s market capitalisation after the bank cancelled its final interim dividend for 2019 and said it would not pay a dividend for at least the first three quarters of the year,” South China Morning Post reports.

JAPANA/ANA – “Japanese airline group ANA Holdings Inc. has asked the government-affiliated Development Bank of Japan and private financial institutions to set up credit lines totaling ¥1.3 trillion, it was learned late Friday. With its revenue from passenger flight services tumbling due to a plunge in demand blamed on the coronavirus pandemic, the company aims to make sure that it can secure loans whenever a need arises through the credit lines as the fight against the new virus could take time, according to sources familiar with the matter,” Japan Times reports.

INDONESIA – “Indonesia’s response to contain the COVID-19 outbreak has been slower compared with some other countries in the region despite policies to limit the economic and financial shock being introduced in a relatively coordinated manner, a credit rating agency has said. ‘Indonesia’s response to contain the coronavirus outbreak has lagged some other countries in the region. But its policies to limit the related economic and financial shock have been introduced in a relatively coordinated manner,’ Moody’s Investor Service wrote in a research note published on Friday,” The Jakarta Post reports.

SINGAPORE – “Manufacturing in Singapore fell to its lowest level since 2009 last month. With factories trying to limit their losses from a recession caused by the coronavirus pandemic, a spike in job cuts is a real risk. The Singapore Purchasing Managers’ Index (PMI) declined 3.3 points to 45.4 in March, said the Singapore Institute of Purchasing and Materials Management (SIPMM). It was the second contraction in a row and the lowest reading since February 2009 when the index was at 45 points, SIPMM said in a statement on Friday (April 3),” Singapore Straits Times reports.

THAILAND – “The Thai economy is forecast to shrink by 4.8% by Asian Development Bank (ADB), 5.6% by Siam Commercial Bank’s Economic Intelligence Center (EIC) and 5% by Standard Chartered Bank (Thai), heading for its deepest contraction since the financial meltdown of 1998. ADB predicts GDP to contract by 4.8% in 2020 before recovering to 2.5% in 2021, the bank said in a recent report,” The Bangkok Post reports.

MALAYSIA/Palm Oil – “Malaysia’s palm oil inventories for March likely slipped below February’s end-stocks to 1.65 million tonnes, as better than expected exports offset a small rise in output likely disrupted by the coronavirus pandemic, a Reuters survey showed. March stockpiles likely fell 1.9% from the previous month, its lowest since June 2017, according to the median estimate of nine planters, traders and analysts polled by Reuters,” Reuters/Edge Markets reports.

PHILIPPINES – “The Asian Development Bank (ADB) downgraded its growth forecast for the Philippine economy this year because of the effects of the coronavirus disease 2019 (Covid-19) pandemic on the country. ‘Economic growth is projected to fall to 2 percent in 2020 before a strong recovery to 6.5 percent in 2021, assuming the Covid-19 outbreak is contained by June of this year,’ the Manila-based multilateral lender said in its Asian Development Outlook 2020 report on Friday,” Manila Times reports.

VIETNAM – Market research firm Fitch Solutions estimates Vietnam’s GDP will grow at its lowest paces in 34 years at 2.8% this year. The growth rate forecast by Fitch Solutions, a unit of credit rating firm Fitch Group, is the lowest since 1986 when the country opened its economy to the world after decades of war,” VNExpress reports.

Middle East Business Telegraph Monitor – April 3

Middle East and North Africa Top Business Stories – April 3

Oil Markets – “The OPEC+ coalition is rushing to pull together a meeting of its members – and possibly other oil producing nations – after President Donald Trump called for a coordinated production cut to stem the historic rout in crude prices,” Bloomberg/Gulf News reports.

Aviation – “The International Air Transport Association (Iata) urged governments to “act faster” to provide financial relief for airlines in the Middle East and Africa, as their collective passenger revenue losses increase to $23 billion (Dh84.48bn) due to the Covid-19 outbreak,” The National reports.

Egypt/Aviation – “Egypt’s airline industry faces a potential loss in revenue of $1.6 billion and 9.5 million fewer passengers due to the coronavirus crisis, the International Air Transport Association (IATA) said,” Ahram Online reports.

Kuwait/Agility – “Kuwait’s Agility, one of the biggest Middle East logistics companies, is taking measures to cut costs and preserve cash as the novel coronavirus pandemic slashes global air freight demand and capacity,” The National reports.

Aviation/Emirates – “Emirates has announced that the airline has received approvals to carry passengers on certain flights, which will start from April 6. The initial flights will commence from Dubai to London Heathrow, Frankfurt, Paris, Brussels and Zurich, with four flights a week to London Heathrow, and three flights a week to the other cities, the airline said,” Gulf Daily News reports.

Libya/Central Bank – “The Head of the Libyan Presidential Council Fayez Al-Sarraj has called on the administration of the Central Bank of Libya (CBL) to attend an emergency meeting to take necessary and urging measures to unite the CBL,” Libya Observer reports.

UAE/Mubadala – “The venture capital arm of Abu Dhabi state investor Mubadala plans to launch a healthcare fund next year to tap into increased demand for investment in life sciences and digital health technology following the coronavirus outbreak,” Reuters/Al-Arabiya Business reports.

Morocco – “‘Give us our money,’ demands a group of home buyers, standing on land that should by now be finished condos — one of many fictitious projects that together comprise what is described as Morocco’s biggest-ever property scam,” AFP/Arab News reports.

Iraq/Coronavirus – “Iraq has thousands of confirmed COVID-19 cases, many times more than the 772 it is has publicly reported, according to three doctors closely involved in the testing process, a health ministry official and a senior political official,” The Baghdad Post reports.

Iran/Coronavirus – “Iran’s death toll from the new coronavirus rose on Friday to 3,294 as it claimed 134 lives in the past 24 hours, according to Health Ministry Spokesman Kianoush Jahanpur,” Reuters reports.

Egypt/Suez Canal – “Traffic in Egypt’s Suez Canal has not been affected so far by the spread of the new coronavirus, the chief of its authority, Osama Rabie, said on Wednesday,” Albawaba reports.

Qatar – “Qatar, the world’s biggest exporter of liquefied natural gas, hired banks to raise more than $5 billion in bonds as early as next week to shore up its finances against the global coronavirus pandemic and oil-price war,” Bloomberg/Daily Star of Lebanon reports.

Whither Belt and Road Amid the Covid-19 Pandemic?

Nikkei Asian Review has a good piece on the fate of China’s Belt and Road Initiative (BRI) amid the global Covid-19 pandemic.

Some excerpts from the piece below:

Some think a weakened China will have little choice but to step back and reassess its foreign investments in the post-pandemic world. But a Belt and Road 2.0 could also present new opportunities to wield influence — especially in Southeast Asia — as the European Union and other investors nurse their own wounds…

Even before the virus panic, the Chinese economy grew just 6.1% last year, the slowest pace in decades. The effects showed up in its investment figures: Foreign direct investment declined by 9.8% from 2018, with nonfinancial outbound direct investment falling 8.2%, according to the Ministry of Commerce.

A closer look, however, shows that while investment in Europe and North America plunged, China’s outlays in Asian countries — particularly Southeast Asia — fell only slightly or even increased. This suggests the region could remain a priority even if Beijing cuts back other investments further.

“The BRI will not end here. It is too important to Xi’s image,” said Jeremy Garlick, assistant professor of international relations at the University of Economics in Prague. “But it may be transformed and streamlined … as the economy contracts.”

The days when China seemingly threw money at everything may be ending, but it still has Xi’s reputation to protect. Overseas projects also remain critical for supporting Chinese corporate earnings and employment while gaining global clout.

MENA Business Telegraph Monitor – April 2

Oil/Saudi/Russia – “Saudi Arabia and Russia signalled on Thursday they were ready to cooperate to help stabilise the oil market after calls with U.S. President Donald Trump to discuss the slump in prices triggered by the end of a deal to curb output and a collapse in demand,” Reuters reports.

GCC Banks – “The outlook for the banking systems of Saudi Arabia, UAE, Kuwait, Bahrain, Qatar has been changed to negative from stable, said credit ratings agency Moody’s Investors Service in a report on Thursday,” Al Arabiya Business reports.

Iraq/Najaf – “The economy of Iraq’s Najaf province, the main centre of Shiism, will collapse in the next few weeks as a result of travel restrictions imposed to contain the country’s coronavirus outbreak, the governor said on Thursday,” The National reports.

Kuwait – “Kuwait’s central bank announced a stimulus package on Thursday to support vital sectors and small and medium enterprises (SMEs) amid the fallout from the coronavirus epidemic,” Gulf News/Reuters reports.

Lebanon Currency – “The battered Lebanese pound has weakened even more during a coronavirus lockdown, with banks blocking access to already scarce dollars, forcing up their price on the parallel market and the cost of imports the heavily indebted country relies on,” The Daily Star of Lebanon/Reuters reports.

Aviation – “The International Air Transport Association (IATA) has urged Middle East governments to support their airlines with regional revenues expected to plunge by almost 40 percent this year as the spread of the coronavirus (COVID-19) paralyzes global travel,” Arab News reports.

Iraq/Kurdistan – “Gazprom Neft, the oil arm of Russian gas giant Gazprom, will not reduce investment in its project in Iraqi Kurdistan despite a request from the semi-autonomous Kurdistan Regional Government KRG to do so, it said on Tuesday,” EKurd.net reports.

Israel/Aviation – “In a notification to the Tel Aviv Stock Exchange, El Al Israel Airlines has announced that, because of the impact of the Covid-19 virus pandemic, it is extending the suspension of its flights to May 2, 2020,” Globes reports.

Oil Price – “Crude oil futures jumped 10% on Thursday after U.S. President Donald Trump said he expected Saudi Arabia and Russia to reach a deal soon to end their oil price war,” The Peninsula/Reuters reports.

Morocco – “Bank Al-Maghrib Governor Abdellatif Jouahri announced new measures that allow Morocco’s central bank to triple resupply of funds to local banks to counter the effects of the COVID-19 outbreak,” The Arab Weekly reports.

Middle East Business Telegraph Monitor – April 1

Middle East and North Africa Top Business Stories – April 1, 2020

Lebanon Debt – “Global investment bank Morgan Stanley said Lebanon would face an uphill task in its efforts to restructure the country’s public debt estimated at $96.5 billion,” The Daily Star of Lebanon reports.

Oil Markets – “Oil slid to $25 a barrel on Wednesday, within sight of its lowest in 18 years, as a report showing a big rise in US inventories and a widening rift within OPEC heightened oversupply concerns,” Gulf Daily News/Reuters reports.

Dubai/Property – “Dubai’s property market will get more time to adjust its supply and demand situation now that the Expo 2020 event is likely to be postponed by 12 months. But, equally important, developers will still need access to new funding – and at a cheaper cost – to make sure ongoing projects do not stall,” Gulf News reports.

Saudi Arabia – “Saudi Arabia has approved the listing of government assets to be privatised on the Saudi stock exchange – Tadawul – following an IPO, the government announced following a virtual meeting on Tuesday,” Arabian Business reports.

Oil Markets – “US President Donald Trump said on Tuesday he would join Saudi Arabia and Russia, if need be, for talks about the sharp fall in oil prices resulting from a price war between the two countries,” Al Arabiya Business/Reuters reports.

Oil Markets – “This is looking like it will be a long and painful oil slump. Even a Russia-OPEC deal, not too likely, will not help much in addressing the enormous demand destruction and buildup of excess stocks. The demand decline in oil markets is massive: 20 million barrels per day or more, not all of which will return even after the crisis ebbs. The price wars have become almost a sideshow, and in their absence, the demand destruction would still hit very hard,” Robin Mills, Middle East oil/gas specialist, says in an interview with New Silk Road Monitor.

Gas Markets – “The impact of current market conditions on gas demand is two-fold. On one hand, it can stimulate demand by increasing its competitiveness compared to other fuels, and on the other hand, reduced economic, industrial and commercial activity can reduce baseload demand, the Doha-based Gas Exporting Countries Forum (GECF) has noted,” The Peninsula reports.

Egypt/Coronavirus – “The COVID-19 pandemic will be devastating to the Egyptian economy in the short term but the overall effect of the disease-induced emergency will depend on how long before it subsides, economists said,” Arab Weekly reports.

GCC Banks – “Gulf banks are limiting their lending to minimize potential losses from the coronavirus crisis and an expected squeeze in dollar liquidity in the oil reliant region, some bankers say,” Reuters reports.

Iran/Coronavirus – “Iran’s president said on Wednesday that, with the advent of the coronavirus, the United States had missed a historic opportunity to lift sanctions on his country, though the penalties had not hampered its fight against the infection,” Reuters reports.

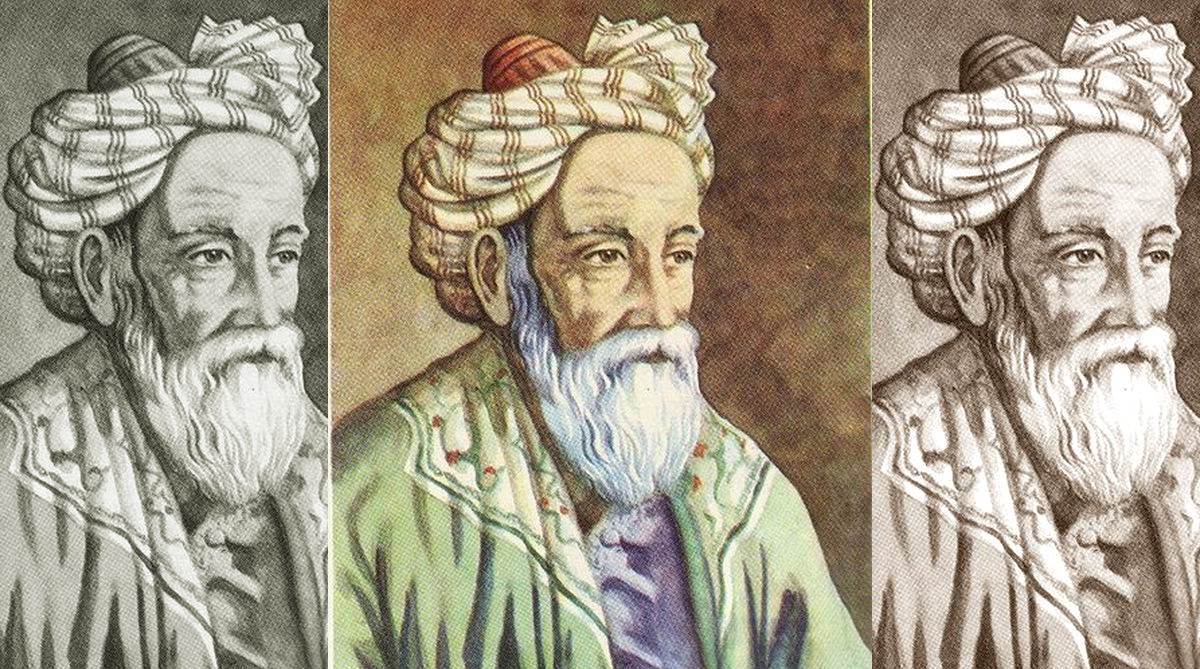

Omar Khayyam: Overheard in the Caravanserai…

Overheard in the caravanserai: a merchant, reflecting on the fleeting nature of life, reciting from Edward Fitzgerald’s version of the Rubaiyat of the great hakim Abu’l Fath Omar ibn Ibrahim Khayyam, otherwise known as Omar Khayyam.

“Oh, come with old Khayyàm, and leave the Wise

To talk; one thing is certain, that Life flies;

One thing is certain, and the Rest is Lies;

The Flower that once has blown forever dies.”

Korean Air Pilots Go on Unpaid Leave to Save Airline

Global airlines continue to stare down the abyss as the novel coronavirus pandemic has crushed bottom lines amid a historic slowdown in air travel. Airlines across the world are clamoring for government support. Korean Airlines is trying a different tactic, opting to put all of its Korean national pilots on unpaid leave for three months, the Korea Herald reports.

More below from the Korea Herald

Korean Air Lines Co. is set to put all of its non-Korean pilots on a three-month unpaid leave starting next month in a self-rescue effort amid worsening business conditions caused by the coronavirus outbreak.

Under the measure, 387 pilots are expected to go on mandatory unpaid leave from April 1 to June 30, an industry source said Tuesday.

Around 60 of them have already been off without pay, the source added.

“(The measure) is aimed at adjusting workforce following a sharp reduction in operations and entry restrictions in countries,” a company official said, adding that the company factored in how foreign national employees will be more liable to tightened border restrictions.

For the full story, see here

Robin Mills on Oil Prices, “Demand Destruction” and Iraq, Oman, and Iran Pain

I’ve known Robin Mills for more than a decade and he is always one of my favorite people to see on my Dubai visits. In one sitting, Robin will take you on a tour d’horizon of the Middle East energy landscape. It’s not surprising to me that Foreign Policy called him “one of the energy world’s great minds.” He is currently CEO of Qamar Energy, and a non-resident fellow at several global think tanks. I spoke with him on the phone recently about the state of oil markets in the wake of the novel coronavirus pandemic and the Saudi-Russia Cold Oil War. Some excerpts from our conversation below:

“Demand destruction”

“This is looking like it will be a long and painful oil slump. Even a Russia-OPEC deal, not too likely, will not help much in addressing the enormous demand destruction and buildup of excess stocks. The demand decline in oil markets is massive: 20 million barrels per day or more, not all of which will return even after the crisis ebbs. The price wars have become almost a sideshow, and in their absence, the demand destruction would still hit very hard. There would have been heavy oversupply. It’s hard to see oil going back to the $60-80 range for quite some time. Prices are likely to go much lower with a slow recovery afterwards.”

“Shale oil will collapse in a extended price war. So, the Gulf becomes volumetrically more important to China again over time, albeit at much lower prices.”

Why the Saudi-Russia Price War?

There are two stories at play. In the first, Saudi was pushing for deeper cuts. Russia said no. Saudi pushed back, maybe misjudged, walked away and declared a price war.

The alternative theory is that the Saudis saw the writing on the wall. They thought we were headed this way toward lower oil prices, so they thought: let’s flood the market to hit shale hard and blame the Russians. There are some signs they were at least prepared for a “no deal” scenario.

Who Will Hurt More? Saudi Arabia, Russia, or Shale?

This will hurt shale producers more than it will the Russians. The American narrative of “energy dominance” has dissolved in the first storm.

Russia is not as exposed today as it was in 2014 [when oil prices fell]. They can weather it. The ruble can depreciate, which will cut capital spending. Ordinary Russians will bear the cost in falling living standards, which is ultimately a test of Vladimir Putin’s popularity and security.

Saudi Arabia has a weaker position. They don’t have a flexible exchange rate. They will burn through cash reserves and will need to make sizeable spending cuts, at a time that the non-oil economy is shut down by coronavirus and needs financial support. However, they can keep going for 2-3 years and expect to drive out higher-cost competitors.

Who Will Get Hit the Hardest?

When you look at the Gulf states, Oman is the most vulnerable. They have a big budget deficit, lots of debt and a limited government wealth fund. Oil production is relatively high cost and will not increase much. In the vicinity, Iraq is even worse-off: a very undiversified economy, an ongoing political crisis, a likely serious virus outbreak, and a heavy budget deficit even before the price crash.

As for Iran, they don’t lose much on crude sales which are already very low because of sanctions, though the remaining exports to China may dry up almost entirely. More seriously, their petrochemical and gas revenues will drop further– end prices are related to oil, and their main customers are now struggling from virus-related crises.

Middle East Business Telegraph Monitor – March 31

Middle East and North Africa Top Business Stories – March 31

Dubai/Emirates Airline – “The Dubai government pledged support for Emirates, the world’s largest long-haul airline, as the coronavirus pandemic hits the global aviation industry, triggering a crescendo of pleas from carriers around the world for state aid,” The National reports.

Turkey Economy – “President Tayyip Erdogan is under growing pressure from unions and the opposition for a lockdown to slow the spread of coronavirus, but insists that Turkey should ‘keep wheels turning’ in the economy and that people continue going to work,” Reuters reports.

Iran Coronavirus – “Iran’s death toll from coronavirus has reached 2,898, with 141 deaths in the past 24 hours, Health Ministry spokesman Kianush Jahanpur told state TV on Tuesday, adding that the total number of infections has jumped to 44,606,” Reuters reports.

Iraq/Umm Qasr Port – “French container transportation and shipping company CMA CGM, has announced the first closing of its agreement with China Merchants Port (CMP), with the sale of its stakes in eight port terminals to Terminal Link. Among the facilities involved is the Umm Qasr Terminal in Iraq,” Iraq Business News reports.

Lebanon Banks – “Banks in cash-strapped Lebanon have suspended dollar withdrawals until the airport reopens, a banking source said on Monday, after authorities grounded flights to halt the spread of the novel coronavirus,” Jordan Times/AFP reports.

Egypt/Sawiris – “Businessman Naguib Sawiris warned Sunday against the continuation of the curfew after the two scheduled weeks, noting that the private sector is forced to cut salaries and cut out part of the employment,” Egypt Today reports.

Algeria/Sonatrach – “Sonatrach group intends to reduce by 50% its budget in 2020 and postpone non-urgent projects following the impact of the new coronavirus (Covid 19) on oil markets, said CEO Toufik Hakkar in an interview with “El-Khabar” daily released Sunday,” Algeria Press Service reports.

Middle East Business Telegraph Monitor – March 30

Middle East and North Africa Top Business Stories – March 30

Oil Price – “Oil prices fell sharply on Monday, with U.S. crude briefly dropping below $20 and Brent hitting its lowest in 18 years, on heightened fears that the global coronavirus shutdown could last months and demand for fuel could decline further,” Reuters reports.

Dubai Expo – “The Expo 2020 Dubai is expected to be delayed by up to a year due to the coronavirus pandemic, according to sources familiar with the matter,” Gulf News/Reuters reports

Lebanon Economy – “Lebanon’s Finance Minister Ghazi Wazni warned that the country’s GDP could drop by 12 percent in 2020 due to the deteriorating conditions,” The Daily Star of Lebanon reports.

Saudi Oil – “Saudi Arabia has announced it will raise its oil exports to a record 10.6 million barrels per day starting from May amid an escalating price war with Russia,” Arabian Business/Bloomberg/AFP reports.

Turkey Banks – “Turkey’s banking sector recorded 15.1 billion Turkish liras ($2.4 billion) net profits as of end-February, the country’s banking watchdog said on March 30,” Hurriyet Daily News reports.

Israel/Aviation – El Al Chairman Eli Defes says that time is running out to save the airline, which seeks a $200-300 million state guaranteed loan, Globes of Israel reports.

Egypt/Coronavirus – “Egypt’s President Abdel Fattah al-Sisi has told the relevant authorities to boost strategic reserves of staple goods, a presidency spokesman said on Monday, as global concerns about food security rise amidst the coronavirus crisis,” Reuters reports.