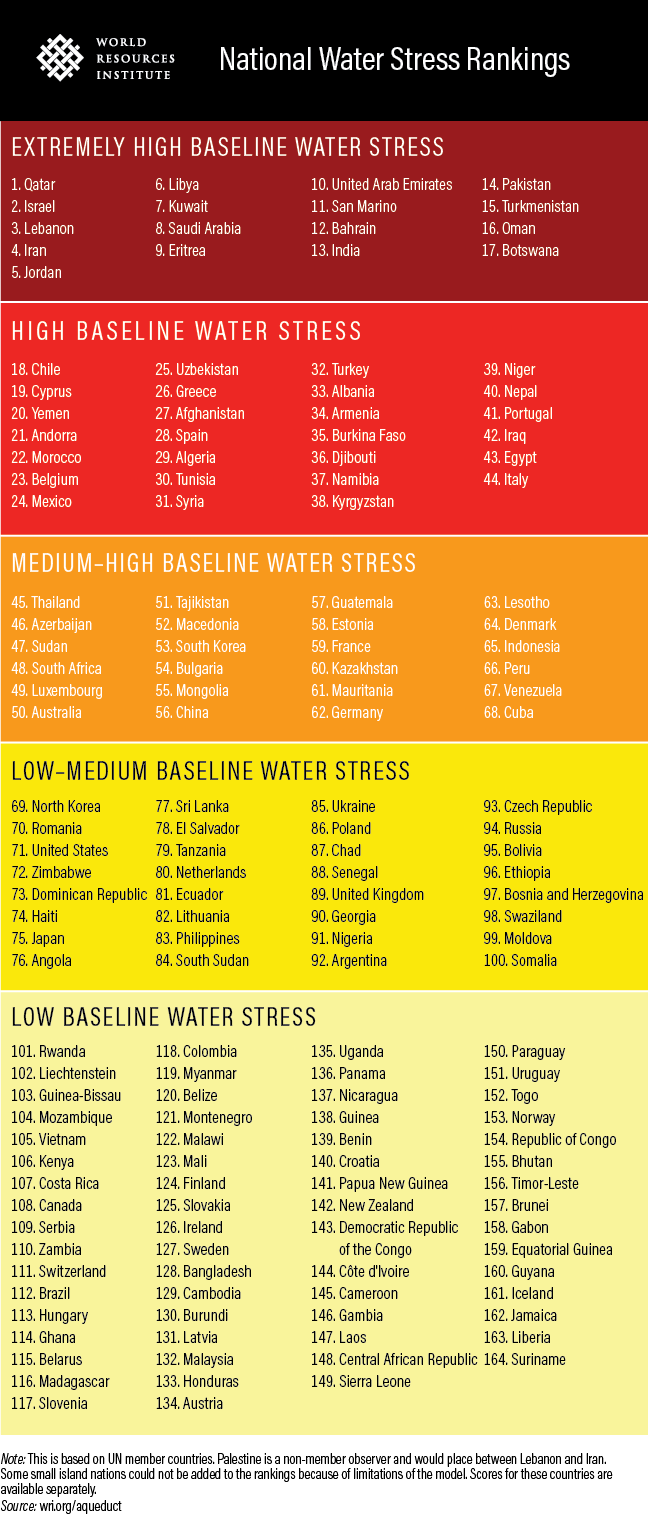

MENA Region Among Most Water Stressed

The World Resources Institute has published its global water stress rankings. Twelve of the seventeen most water-stressed areas are in the Middle East and North Africa region. See below – and for the full release from WRI, see here

5 Warning Signs Flashing Across Asia

It has become a familiar feature of the regular unveiling of the IMF’s latest World Economic Outlook: Asia consistently outpaces the rest of the world in terms of growth. In July, the IMF reported that emerging and developing Asia is expected to see 6.2% growth in 2019-20, far outpacing sluggish growth in Europe, modest growth in the United States, and broader emerging markets growth.

Still, over the past week some warning signs have emerged, suggesting that there may be more trouble than the rosy numbers suggest. No doubt, the U.S-China trade dispute roiling the global economy is also roiling Asian economies, but Hong Kong protests, the South Korea-Japan dispute and a slowing India are also playing a role.

While this humble site still believes that the unique combination of demographics, rapid urbanization, unprecedented connectivity and rising middle classes will likely continue to drive Asia forward, it is important to watch these 5 warnings signs flashing across Asia

#1 – Singapore, the Asian trade hub, cut its forecast for economic growth this year to almost zero. Trade hubs like Singapore, Hong Kong, and Dubai often serve as the canary in the coal mine, as their growth is often highly dependent on global trade growth. So, when Singapore slows, there may be something foul in the air.

#2 – Hong Kong, wracked by 10 months of protests and whipsawed by the US-China trade dispute, is likely headed for a recession. What’s even more troubling, as Bloomberg rightly noted, could be that “Hong Kong’s standing as a safe and reliable commercial hub will face irreparable damage – a potential death blow for an economy that has leveraged its business-friendly reputation to become the primary gateway between China and the rest of the world.”

#3 – It has become well-known that China recently had its worst quarter since 1992, with a reported 6.2% growth. Even more troubling, China continues to pile up debt, with the latest tally at $1.5 trillion of dollar-demonimated debt held by Chinese firms. China’s total debt now tops 300% of GDP. Watch this debt space.

#4 – Passenger vehicle sales fell in India in July by 31%, but this was no one-off fluke. It marks the ninth straight month of passenger vehicle sales falls, raising questions about the oft-heralded rising Indian middle class consumption story driving the future. What’s more, rising tensions between India and Pakistan will not be good for foreign direct investment for either side, particularly jarring for Pakistan, not long ago an emerging market investment darling.

#5 – South Korea downgraded its trade relationship with Japan amid continued disputes over Japan’s World War II crimes committed against forced Korean laborers. This Tokyo-Seoul sparring comes at a poor time for both sides as they face the shrapnel of the U.S-China trade dispute and rising protectionism emanating from the United States.

We will continue to watch these warning signs, though it does not change the fundamental view of this site, well-articulated by friend and fellow traveler, Parag Khanna, that “The Future is Asian.”

Asia’s Top 10 Retailers – 2019

The good folks at EuroMonitor International continue to produce some of the finest research on Asia’s economic transformation. Their latest report, downloadable on their site, looks at the Asian Retail Landscape.

These are the Top Ten companies within retailing in the Asia-Pacific region in terms of sales. I have also listed their home country HQ in parentheses, but have not listed sales figures until I understand their methodology better.

- Alibaba Group Holding Ltd (China)

- JD.Com (China)

- Seven and I Holdings Co Ltd (Japan)

- AEON Group (Japan)

- Amazon.com Inc (USA)

- Suning Commerce Group Co Ltd (China)

- Walmart Inc (USA)

- Lotte Group (South Korea)

- Family Mart UNY Holdings Co Ltd (Japan)

- Shinsegae (South Korea)

Whither The China Debate in Washington?

Here’s something you will hear often in general macro discussions of U.S policy: “there is a bi-partisan consensus forming that we need to get tougher on China.” That may be true among the political classes, but there is a robust debate among China specialists about the direction U.S policy should take. Nahal Toosi of Politico outlines the broad contours of the debate in her sharp piece with an evocative headline: “‘when paradigms die’: China veterans fear extinction in Trump’s Washington.”

A few excerpts from the piece

President Donald Trump’s push to toughen U.S. policy toward China has won over much of the Washington establishment, touching off a seismic shift in how many Americans view Beijing.

But one group is resisting — those who have spent decades pursuing diplomacy with China and who fear their approach might go extinct.

These former officials, diplomats and scholars are wary about the rise of a younger foreign policy generation that is almost uniformly more skeptical of China, never having experienced the impoverished, isolated country it once was. And they’re warning that the increasingly hard-line stance emanating from Washington — from both Republicans and Democrats — could unravel decades of relationship-building, raise the risk of a U.S.-China military confrontation and even lead to a new era of McCarthyism in America.

“I’m a globalist — I want the U.S. to be engaged in the world, including with other major countries like China,” said Susan Thornton, who oversaw East Asian and Pacific affairs in 2017 and 2018 at the State Department and was viewed by some Trump aides as too soft on Beijing. “The reality is China is not going anywhere. It’s one-fifth of humanity.”

Thornton went public with her concerns earlier this month, when she joined about 100 others to publish an open letter to Trump and members of Congress titled “China is not an enemy.”

Now, pair Nahal’s piece with this this illuminating Sinica podcast with the always excellent Kaiser Kuo of SupChina in conversation with Ryan Hass of Brookings that dives deep into the bi-partisan consensus on China narrative, offering criticism of China where it is due and nuance and context where it is also due.

It’s truly one of the best conversations on the China debate you will hear.

Whither Globalization? – A Very Smart Bloomberg Deep Dive

Bloomberg’s journalism just keeps getting better and better by the month. Here’s a vital, must-read piece on the state of globalization by Shawn Donnan and Lauren Leatherby. A few excerpts that caught my eye below, but go to Bloomberg and read the whole piece here

Globalization is a force both more powerful and ancient than Trump. Too often we think of it—of economic integration and the exchange of ideas, people and goods that comes with it—as a recent phenomenon.

The reality is it has been with us since the dawn of time. Religions like Christianity and Islam are products of globalization. They also have arguably done more to both shape and promote globalization than U.S. multinationals or China’s new corporate giants.

Globalization also isn’t a static force. We associate globalization today with the shipping container, the 1950s invention that increased the efficiency and lowered the cost of the global trade in goods. Or with the outsourcing of jobs in advanced economies and the rebirth of great trading economies like China’s.

But we are entering a new era in which data is the new shipping container and there are far more disruptive forces at work in the world economy than Trump’s tariffs. New manufacturing techniques such as 3D printing and the automation of factories are reducing the economic incentives to offshore production. The smartphones we carry with us are not just products of globalization but accelerants for it. For good or bad, we are more exposed to a global culture of ideas than we have ever been. And we are only becoming more global as a result.

Is globalization really slowing? Maybe, if you only look at the trade in physical goods. But that doesn’t take into account an explosion of the digital economy. That’s important. Increasingly, the digital realm is where the 21st-century economy lives….

As economies mature, we’re selling the rights to produce something to someone in another country rather than shipping it to that country. Those changes also mean less physical trade in goods—no CD crosses a border if you’re streaming the latest Ariana Grande song. Yet that doesn’t mean globalization is slowing. It means it is maturing and evolving.

Traditional trade measures also don’t reflect the real supply chain

There is no economic relationship bigger than the U.S. and China’s. But how you quantify the flows matters. Traditionally, trade data measures shifts in goods by recording products’ value when they leave a port. But the parts in products often come from other countries these days. Even those parts can be made up of parts from elsewhere. That means a more accurate measure of trade and economic relationships involves recording where value is added. And when you do that, relationships start to look different.

Photo of the Day – Istanbul

I think we’ve all seen — and marveled — at shots of Istanbul along the Bosphorous, evoking both the complex history of the modern mega-city, its vital role as a sea trade connector between the Mediterranean and the Aegean, as well as its current energy as a commercial hub. I think this one here by photographer Shahriar Etminani is one of the best I’ve ever seen, You can see more of his photos here.

And if you are looking for a good read on Istanbul, check out Istanbul: Memories and the City, by Orhan Pamuk.

The African-American Artist Who Found “a Homeland” in Oman

Last night, I attended an event at the Sultan Qaboos Cultural Center in Washington D.C – an often overlooked gem in the heart of mid-town — and came across this painting that caught my eye. It certainly has a 19th century New Silk Road-y feel to it. Upon further examination, I noted the name of the painter – E. Harper Johnson – and he turns out to be a fascinating African-American artist who spent his final years in Oman under the patronage of the Sultan – the two men seen here.

He was born in Birmingham, Alabama in 1916, and died in Muscat, Oman in 2016. In that span of 100 years, he illustrated more than a dozen books and and worked for some leading publications. A consummate artist, he was also a talented vocalist and violinist (though his violin career ended with a broken wrist injury as a youth). In his later years, he began traveling to East Africa and the Arabian peninsula, and eventually settled in Oman after 1993. After being granted Omani nationality by Sultan Qaboos, he said, “I have finally found my homeland after a long, tiring life, full of travel and work.”

His is a life worth exploring further. If any New Silk Road Monitor readers know more about E Harper Johnson’s years in Kenya or Oman, please write.

Gikomba Market – Nairobi – Photo of the Day

The bustling heart of Gikomba market in Nairobi. It swells to a million-strong on any given Saturday.

Photo Courtesy of Vahid Fotuhi, Clean Energy Entrepreneur, delivering sustainable energy to Africa and Asia – and a darn good photographer too! I look forward to publishing more of his work. Thanks, Vahid!

The New Silk Road Monitor Friday Post

The New Silk Road Monitor “Friday Post” – A round-up of this week’s stories that caught our eye

Insights on Investing in Africa, the UAE and the Belt and Road, Turkey’s New Silk Road Logistics Play, Russia’s New Silk Road Highway, the Africa Continental Free Trade Area and More

The UAE as a Linchpin of the Belt and Road – By Jonathan Fulton in Al-Monitor

For Africa Investment, Look Beyond GDP Numbers – By Paulo Gomes, Project Syndicate

China, The G20, Africa, and the Future of World Trade – By Hannah Ryder in China Watch

Africa’s Massive 54 Country Trading Bloc – By Grace Shao, CNBC

Time for the U.S To Step Up in Promoting Africa Investments – By Aubrey Hruby, RealClear World

The Explosion of Tech Hubs Across Africa – By Yomi Kazeen, Quartz Africa

Turkey’s Logistics Play Along the Silk Roads – Logistics Middle East

Russia’s New Silk Road Highway – DM Chan, Asia Times

Podcasts

Ryan Hass of Brookings joins Kaiser Kuo of Sinica: A Multi-Layered China Policy Podcast

Urban Transportation Lessons for Africa from China: Eric Olander’s China-Africa Podcast Speaks to Robert Earley

Video

Dr Carlos Lopes on the Africa Continental Free Trade Area, CGTN

Are China and India Recalibrating Their Relationship?

It’s no secret that Prime Minister Narendra Modi and China President Xi Jinping don’t see eye to eye on a range of issues, including a long-simmering and sometimes flaring border dispute, the Belt and Road Initiative, and China’s close ties with Pakistan. No one, however, can accuse the two leaders of not communicating.

Consider the following:

- On June 13, the two leaders held a bilateral meeting in the Kyrgyz capital, Bishkek, as part of the Shanghai Cooperation Organization annual meeting

- Xi and Modi will will hold another bilateral meeting this week in Osaka, Japan as part of the G20 leaders summit

- In addition to the two bilateral summits within two weeks of each other, the two leaders will also meet during a separate Russia-India-China summit during the G20

- They will also meet as part of the informal BRICS meeting on the sidelines of the global gathering.

If you are counting, that’s 4 tete-tete’s in less than a month. And if that’s not enough, India will host the second edition of the informal India-China summit later this year, the Economic Times reports, and the two will meet again at a BRICS summit in Brazil toward the end of the year.

Abhijnan Rej has a great piece in the Diplomat, arguing that we are witnessing a profound shift in Indian foreign policy thinking on China, and the world’s two most populous states may be on the verge of a fundamental recalibration of ties. He writes:

As the New Delhi commentariat continues to be riveted by the possibility of a rapprochement between India and Pakistan, a much more pronounced rebalancing when it comes to China is underway.

When the Party Secretary of Guangdong province and Central Politburo member Li Xi met [India Foreign Minister] Jaishankar on June 6, the normally-scrutinizing media here – one that pays particular attention to who is in town and for what – failed to realize its significance. First, reports only perfunctorily noted that the Hong Kong-bordering Guangdong by itself is a major economy a GDP of more than $1.4 trillion, making it bigger than Australia in economic size as well as the fact that Modi’s home state of Gujarat has a particularly close relationship with that province, as “sister states.”…

Li’s visit to New Delhi, thus, is far from devoid of serious significance. One can be all but certain that Li came as Xi’s emissary, though it is unclear to what extent his India trip was planned ahead of the elections here. Whatever be the case, this visit fits nicely in a pattern of low-key but significant engagements between the two countries. Indian press reports have noted an uptick in party-to-party ties, between Modi’s Bharatiya Janata Party (BJP) and the CPC, with a BJP source noting that a high-level delegation from their party to China could be in the making.

If Li’s visit to New Delhi portends to an ongoing recalibration of India-China ties, the rise of the political fortunes of his host, foreign minister Jaishankar, is no less a sign of things to come. While most commentators have focused largely on Jaishankar’s contributions to the U.S.-India relationship (and sotto voce expect him to arrest its downturn), some see in his appointment as foreign minister a concerted effort on Modi’s part to cool temperatures with China.

With India-China trade expected to hit $100 billion this year, both sides may also be following the money toward a more nuanced relationship. Watch this space.